Applying the Monte Carlo Technique to Option Pricing

Apr 1, 2022·,,,,,·

0 min read

Sam Ansell

Jack Burrows

Zhiyuan Lei

Junya Lui

Abi Pibworth

Josh Tilford

Abstract

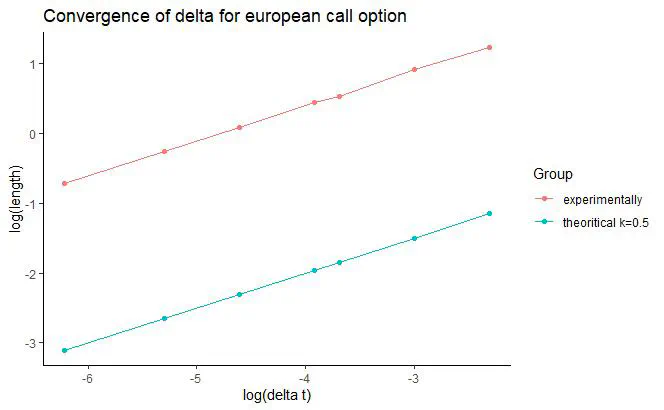

This report outlines an investigation into the use of Monte Carlo methods in financial option pricing and random number generators. Specifically, this report produces simulations for two types of call options, European call option and binary asset-or-nothing call option, using an analytical approach, a weak-Euler scheme and a Milstein scheme. A Monte Carlo method has been applied to the weak-Euler scheme to examine the option prices and delta values across various time points. The convergence rates of price and delta have been plotted and compared to the theoretical convergence rate.